Contents:

Proper authorization of transactions and activities helps ensure that all company activities adhere to established guide lines unless responsible managers authorize another course of action. For example, a fixed price list may serve as an official authorization of price for a large sales staff. In addition, there may be a control to allow a sales manager to authorize reason able deviations from the price list. Segregation of duties requires that different individuals be assigned responsibility for different elements of related activities, particularly those involving authorization, custody, or recordkeeping.

- In any event, in a cascading responsibility, a manager is effectively a chief executive of his or her sphere of responsibility.

- The most significant advantage of accounting controls is that it restores the general public’s faith in the public listed companies.

- Also, internal controls are designed to address normal transactions and not unusual transactions.

- Examples of detective controls include an inventory count, internal audits, and surprise cash counts.

- They can be an integral part of operations that can help mitigate risks and add business value.

The AICPA, IIA, and ACFE also sponsored a guide published during 2008 that includes a framework for helping organizations manage their fraud risk. Internal controls in accounting play a vital role in preventing and detecting errors and frauds. Thus, they help ensure that the company’s financial records are accurate and reliable when it’s time for a audit.

Accounting is the language of business

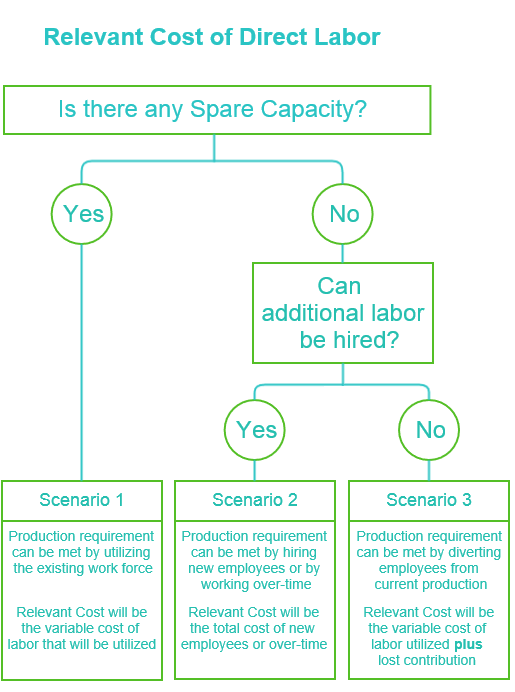

Internal control is the general responsibility of all members in an organization. However, the following three groups have specific responsibilities regarding the internal control structure. Preventive controls aim to decrease the chance of errors and fraud before they occur, and often revolve around the concept of separation of duties. From a quality standpoint, preventive controls are essential because they are proactive and focused on quality. Deloitte & Touche LLP insights on the latest U.S.-focused accounting, financial reporting, regulatory, and industry developments.

This will facilitate the consistent operation of these controls and avoid any exceptions being noted within an audit report. Review financial reports and activity logs to ensure procedures are being properly followed. For example, our firm recommends using Bill.com to streamline accounts payable processes, set up roles and permissions, and ensure vendors are paid on time. However, many accounting software options can automate many of the monotonous, mind-numbing aspects of internal control measures so managers and directors can focus on the areas that drive the company forward. Internal controls are measures that you put in place to ensure that your accounting operations and workflows are effective, efficient, reliable, and compliant with applicable regulations. Designating managers to be responsible for transaction authorizations is an internal control function that funnels purchase decisions through the most trusted employees.

One of the primary goals behind internal control measures is to make sure that no single person controls a process from start to finish. For example, someone who records bill payments shouldn’t also write checks since they could easily create fake vendors and siphon money out of your company. The goals of internal control measures are to prevent, detect, and correct issues that impact the accuracy, integrity, and reliability of a company’s financial information. Implementing the proper accounting controls is meaningless unless employees are equipped to act when they notice a problem or detect suspicious activity.

Formal policies must be created to educate employees on how to respond when issues arise. All employees should know who they can tell when there is suspicion of error or malicious intent and what kind of response to expect. This also makes it a compulsion for organizations to follow corporate disclosure guidelines and other requirements. The point here is that accounting controls are nowadays an integrated part of any organization, without which the accounting system is like a car without brakes, and no one wants to take a ride in such a car. So any organization which aspires to grow big and better must have robust accounting control in place.

Restrict Employee Access to Financial Systems

Please contact us if you need assistance with setting up your internal accounting controls. However, errors and fraud can still exist in a double-entry accounting system, which is why trial balances should be used in conjunction with this method. Trial balances are a form of accounting control that infuse additional reliability into the system by keeping an internal record of credits and debits to allow businesses to identify issues early on. In small companies where there are not enough employees to separate duties completely, peer review can serve a similar “checks and balances” function to mitigate risk. While complacence and collusion can still result in erroneous reporting, requiring peer sign-off on reports and job functions can eliminate simple opportunistic theft.

State audit of Kentucky State finds ‘poor’ internal controls, wasteful … – WUKY

State audit of Kentucky State finds ‘poor’ internal controls, wasteful ….

Posted: Wed, 22 Mar 2023 07:00:00 GMT [source]

The statement of retained earnings style and the expectations of upper‐level managers, particularly their control policies, determine the control environment. An effective control environment helps ensure that established policies and procedures are followed. On the other hand, Internal Controls refers to procedures, checks and balances established by a company’s management to ensure that financial records are accurate and reliable for external users. The accounting systems may include some aspect of internal controls such as price verification.

Ways to Improve Internal Accounting Controls

Manually counting assets in this manner is crucial because fraud can occur off the books to bypass financial report audits. AuditorsAn auditor is a professional appointed by an enterprise for an independent analysis of their accounting records and financial statements. An auditor issues a report about the accuracy and reliability of financial statements based on the country’s local operating laws. Financial StatementsFinancial statements are written reports prepared by a company’s management to present the company’s financial affairs over a given period . These statements, which include the Balance Sheet, Income Statement, Cash Flows, and Shareholders Equity Statement, must be prepared in accordance with prescribed and standardized accounting standards to ensure uniformity in reporting at all levels. Financial statements are written reports prepared by a company’s management to present the company’s financial affairs over a given period .

Once these issues have been identified, managers can take steps to reduce the risk of their re-occurrence, typically by altering the underlying process. For example, a physical inventory count can spot cases in which actual inventory quantities are lower than what is recorded in the accounting records. Or, a bank reconciliation is used to detect unexplained withdrawals from a savings account. Preventive controls are intended to keep a loss from occurring in the first place.

Segregate duties among staff to reduce opportunities for internal fraud

Communicating with management about any lapses in internal controls is the best way to mitigate risks quickly. Though audit teams likely have hundreds or even thousands of data points, taking a proactive approach toenterprise risk managementis essential. You can increase the safety of your assets by having a third party review your company’s accounts. Any employees who are involved with internal accounting and aware of your third-party review will be deterred from fraudulent practices.

Low means that the client’s https://1investing.in/ controls are strong and maximum means that the controls are virtually useless. If executive and management teams disregard existing controls, employees will likely follow suit. Compliance can also happen from the bottom up since audit teams can use their data to make abusiness case for cyber risk management. In a fast-moving, unpredictable world, long-standing structures often struggle to keep up.

Larger projects, such as hand counting inventory, should be performed less frequently, perhaps on an annual or quarterly basis. It’s unfortunately common for companies to jump into designing internal controls without first understanding the operational risks and key threats facing them. While many internal control measures are standard, it’s best to adopt a risk management perspective when designing internal controls. This way, you avoid gaps or insufficiency within your organization’s system of internal controls.

- In small companies where there are not enough employees to separate duties completely, peer review can serve a similar “checks and balances” function to mitigate risk.

- Physical audits include hand-counting cash and any physical assets tracked in the accounting system, such as inventory, materials and tools.

- Comprehensive budget – A government-wide budget that includes all resources the government expects and everything it intends to spend or encumber during a fiscal period.

- Standardizing documents used for financial transactions, such as invoices, internal materials requests, inventory receipts and travel expense reports, can help to maintain consistency in record keeping over time.

- Documentation and recordkeeping, which requires all transactions to be documented and recorded to ensure they can be properly traced and reconciled with the accounting records.

Application controls which are also known as automated controls have a few benefits. One benefit is that because the control is the result of a configuration, they generally do rely on an individual to operate consistently. That being said, it is always a good idea to periodically check to confirm that the configuration has not been disabled for any reason or the configuration has not been modified.

Develop innovative solutions within your accounting and internal controls, build trust and discover new digital opportunities, with us at your side. This internal control requires members of the management team to authorize specific transactions. Approval authority adds a further layer of responsibility to accounting procedures because it proves that any transactions have been analyzed and approved by the appropriate managers. When accounting documents such as inventory receipts, invoices, internal materials requests, and travel expense reports are standardized, this can help to maintain consistency in the company’s records. Standardized document formats also make it easier to review past records when a discrepancy has been found in the system.

Big Four’s Stormy Spring Resurrects Fear About Audit Quality (1) – Bloomberg Tax

Big Four’s Stormy Spring Resurrects Fear About Audit Quality ( .

Posted: Tue, 11 Apr 2023 09:11:24 GMT [source]

Every individual working in the organization is responsible for properly implementing these controls. Starting from the board of directors, vice-presidents, senior management, managers, and employees, they have to take the responsibility of accessing, adopting, implementing, reviewing, and transforming the controls as and when required. › The Internal Control Checklist is a tool for the campus community to help evaluate and strengthen internal controls, promote effective and efficient business practices, and improve compliance in a department or functional unit. Internal controls are broadly divided into preventative and detective activities. Internal audits play a critical role in a company’s operations andcorporate governance, now that theSarbanes-Oxley Act of 2002has made managers legally responsible for the accuracy of its financial statements. Adequate documents and records provide evidence that financial statements are accurate.

I would place the keys in a secure area that could be locked, such as a safe or a desk drawer or cabinet. Only a manager or supervisor would have access to these keys, and workers would have to sign out the keys via a logbook. This would ensure a solid chain of custody and accountability regarding access to the delivery van. Ted is a bookkeeper in the accounting department of a local department store.